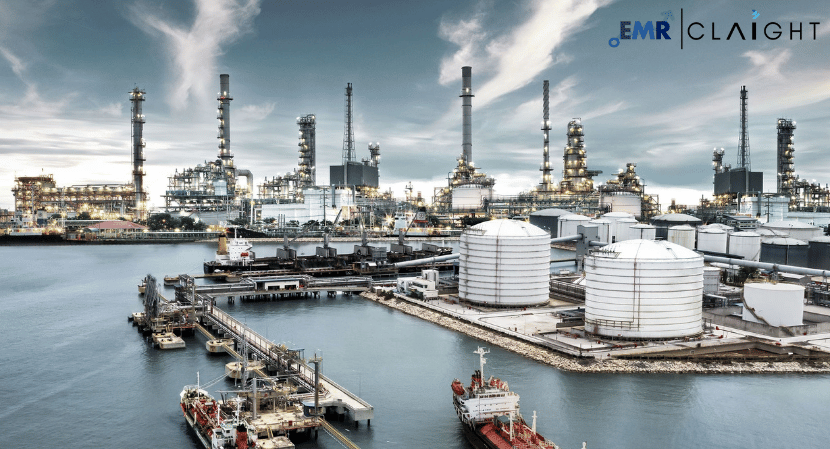

Nigeria Oil and Gas Market Outlook

The Nigerian oil and gas sector is a vital component of the nation’s economy, contributing significantly to its GDP, government revenue, and foreign exchange earnings. The market is characterized by vast hydrocarbon resources, a complex regulatory environment, and a range of domestic and international companies operating across various segments. This analysis focuses on the trends and projections for the gas and oil markets in Nigeria, highlighting key players and factors influencing growth.

Market Overview

Gas Market

The Nigerian gas market reached a volume of 1.37 million metric tons (MMT) in 2023. The market is poised for growth, with an expected compound annual growth rate (CAGR) of 5.30% from 2024 to 2032, anticipating a volume of 1.85 MMT by 2032. Several factors contribute to this growth trajectory:

- Increased Domestic Demand: The rising demand for gas for power generation and industrial applications is driving market growth. Nigeria’s energy sector is undergoing transformation, with a focus on improving electricity supply through gas-fired power plants.

- Gas Export Opportunities: Nigeria is looking to increase its gas exports, particularly to Europe and other international markets. The potential for liquefied natural gas (LNG) exports is significant, given global shifts towards cleaner energy sources.

- Infrastructure Development: Ongoing investments in gas processing and transportation infrastructure, including pipelines and LNG facilities, are expected to enhance the supply chain and facilitate market growth.

- Government Policies: The Nigerian government is implementing policies to promote gas utilization, aiming to diversify the energy mix and reduce dependence on oil. Initiatives include the National Gas Policy, which aims to develop the gas sector and attract investments.

Get a Free Sample Report with Table of Contents@https://www.expertmarketresearch.com/reports/nigeria-oil-and-gas-market/requestsample

Oil Market

In the same period, the Nigerian oil market recorded a volume of 441 thousand barrels per day (kb/d) in 2023. The market is projected to grow at a CAGR of 3.60% from 2024 to 2032, reaching 542 kb/d by 2032. Several key factors underpin this growth:

- Reserves and Production Capacity: Nigeria is one of Africa’s largest oil producers, with significant reserves that provide a foundation for sustained production levels. Efforts to enhance production efficiency and reduce operational challenges are vital for maintaining output levels.

- Global Oil Demand: The global demand for oil is expected to stabilize and grow, particularly as emerging economies expand. Nigeria’s strategic position as a key supplier to international markets supports the potential for increased exports.

- Investment in Exploration and Production: The Nigerian government and private sector companies are investing in exploration and production activities, focusing on both onshore and offshore reserves. This investment is essential for maintaining production levels and meeting future demand.

- Regulatory Environment: The passage of the Petroleum Industry Act (PIA) aims to reform the oil and gas sector, enhancing transparency and creating an enabling environment for investment. This regulatory framework is expected to attract both domestic and foreign investments.

Key Players in the Market

The Nigerian oil and gas market is characterized by the presence of both national and international companies. Key players include:

- Nigerian National Petroleum Corporation (NNPC): The state oil corporation responsible for the exploration and production of oil and gas resources. NNPC plays a central role in the industry, managing joint ventures and production sharing contracts with international oil companies.

- Exxon Mobil Corporation: A major player in Nigeria’s upstream oil sector, ExxonMobil operates significant oil and gas fields and is involved in various exploration and production activities.

- Total Energies SE: Total has a strong presence in Nigeria, engaging in upstream oil production and gas development, contributing significantly to the country’s energy supply.

- Shell Plc: Shell is one of the largest operators in the Nigerian oil sector, involved in exploration, production, and refining activities. The company plays a crucial role in the country’s oil production.

- Chevron Corporation: Chevron is actively involved in Nigeria’s oil and gas industry, focusing on both exploration and production, as well as gas development projects.

- Lekoil Nigeria Limited: An independent oil and gas exploration company, Lekoil focuses on offshore assets and is actively working to enhance its production capacity in Nigeria.

- Sterling Oil Exploration & Energy Production Co. Ltd.: This company operates in the upstream segment, focusing on exploration and production activities in Nigeria’s oil and gas sector.

- Pinnacle Oil and Gas Company Limited: Pinnacle is involved in the downstream segment, providing various services related to oil refining and distribution.

- CNOOC International Ltd.: CNOOC has a presence in Nigeria’s oil sector, focusing on exploration and production activities, contributing to the country’s overall output.

- Eni S.p.A.: Eni operates in Nigeria’s upstream oil sector, focusing on exploration and production of oil and gas resources.

- Others: The market also includes several other domestic and international players contributing to Nigeria’s oil and gas landscape.

Challenges Facing the Market

Despite the growth prospects, the Nigerian oil and gas market faces several challenges:

- Regulatory and Political Instability: The regulatory environment in Nigeria has historically been complex and subject to change. Political instability and regulatory uncertainty can hinder investment and operational efficiency.

- Infrastructure Deficiencies: Inadequate infrastructure for transportation, processing, and distribution remains a significant challenge. Investments are needed to enhance pipeline networks and processing facilities.

- Security Concerns: The oil-producing regions of Nigeria have experienced security challenges, including vandalism and piracy. These issues pose risks to operations and can disrupt production activities.

- Environmental Concerns: Environmental degradation and pollution resulting from oil spills and gas flaring are critical concerns. There is growing pressure on companies to adopt sustainable practices and address environmental impacts.

Future Outlook

The outlook for the Nigerian oil and gas market is cautiously optimistic. The projected growth in both the gas and oil markets presents opportunities for investment and development. Key trends to watch include:

- Diversification of Energy Sources: The Nigerian government is keen on diversifying its energy sources, emphasizing gas utilization to support industrialization and improve energy access.

- Investment in Renewable Energy: While the oil and gas sector remains crucial, there is a growing emphasis on renewable energy sources as Nigeria seeks to balance its energy mix and address sustainability concerns.

- Technological Advancements: The adoption of advanced technologies in exploration, production, and processing can enhance operational efficiency and reduce costs in the oil and gas sector.

- Regional Cooperation: Collaborations with neighboring countries and international partners can enhance Nigeria’s position as a key player in the West African oil and gas market, fostering regional integration.

Media Contact:

Company Name: Claight Corporation

Contact Person: Eren smith, Corporate Sales Specialist – U.S.A.

Email: sales@expertmarketresearch.com

Toll Free Number: +1-415-325-5166 | +44-702-402-5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: https://www.expertmarketresearch.com

Aus. Site: https://www.expertmarketresearch.com.au

More Stories

PVD-Coated vs. Traditional Furniture: Who win?

PCD Pharma Franchise Company in Baddi: Oasis Bio Bloom

Brass Hose Fittings: Perfect for Any Industry